My favorite monument

Which of the monuments administered by the Centre des monuments nationaux is your favourite?

Presentation

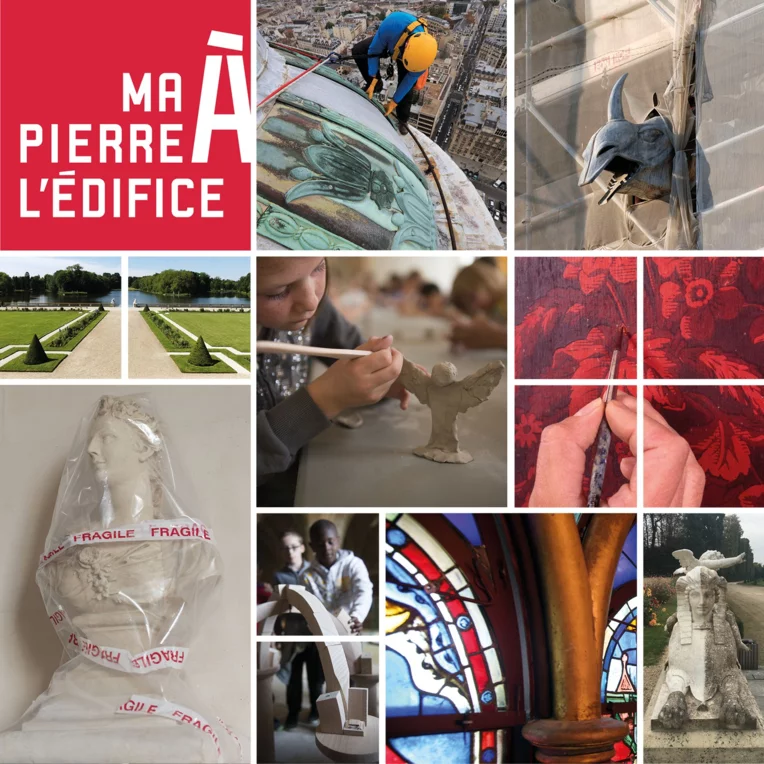

Ma Pierre à l'édifice

video | Reading time min

An advantageous tax reduction

If you are an individual, whatever the amount of your donation, 66% of the sum is deducted from your income tax (up to a limit of 20% of taxable income). For example, a donation of €100 actually costs €34, giving you a tax reduction of €66. If this reduction exceeds 20% of your taxable income, the excess can be carried forward for five years.

If you make a donation on behalf of your company, whatever the amount of your donation :

- 60% of the amount is deducted from your corporate income tax, up to 2 million euros

- 40% for donations over this amount.

In accordance with the law of August 1, 2003 on sponsorship, associations and foundations, the amount of the tax reduction is capped at 0.5% of sales excluding tax, and can be carried forward for up to 5 fiscal years.

Contact us

-

Ma pierre à l'édifice

mapierrealedifice@monuments-nationaux.fr